In the realm of online commerce, businesses encounter various challenges,...

Read MoreTickleCharge - Your Comprehensive Payment Solution for High-Risk Industries

Accept Visa, MasterCard, Discover, Amex, JCB, and Crypto with easy all-inclusive merchant integration

About us

At TickleCharge, we understand the challenges high-risk businesses face when it comes to payment processing. That is why we offer comprehensive payment solutions tailored to your business needs. We work tirelessly to negotiate the best rates from our network of payment processors and banks, and we provide unparalleled tech, legal and consultancy support and future-ready fintech solutions to ensure that your business stays ahead of the curve.

We help high-risk businesses like yours secure merchant accounts that fit your unique needs. We know that sometimes, unknown mistakes or information on your website can cause delays or problems in getting a merchant account, but with TickleCharge on your side, you can trust our expertise and guidance. We also offer assistance with all the necessary paperwork to ensure that your merchant account is set up correctly.

Our key service USP is our ability to handhold clients through the merchant’s journey.

Customized Solutions

Our tailored approach ensures that your payment processing is not just efficient but also perfectly suited to your business and pocket.

Expert Guidance

From tackling bank paperwork to staying updated on evolving regulations and ensuring robust security measures, we've got you covered.

Fraud and Chargeback Support

Connect with one of our third-party fraud protection experts, to safeguard high-risk industries, offering you a solid defense against potential threats.

Legal Support

In the world of changing rules, a specialised high-risk lawyer is like a shield against uncertainty. Talk to one of our partner lawyers to get your legalities streamlined.

Customized Solutions

Our tailored approach ensures that your payment processing is not just efficient but also perfectly suited to your business and pocket.

Expert Guidance

From tackling bank paperwork to staying updated on evolving regulations and ensuring robust security measures, we've got you covered.

Fraud and Chargeback Support

Connect with one of our third-party fraud protection experts, to safeguard high-risk industries, offering you a solid defense against potential threats.

Legal Support

In the world of changing rules, a specialised high-risk lawyer is like a shield against uncertainty. Talk to one of our partner lawyers to get your legalities streamlined.

Here’s how TickleCharge helps merchants maintain high payment security standards and comply with the latest SCA requirements.

3DS challenges

The primary obstacles to successful 3DS implementation in Europe arise from the incomplete processing of payments. This can result from issues with the authentication methods being unfamiliar or technically problematic, or from malfunctions in the backend systems responsible for payment flows.

Why implement 3DS?

The applications of 3DS extend beyond merely facilitating payments. Processes such as adding cards to digital wallets, integrating open banking services, and incorporating 3DS into financial services applications all take advantage of its functionalities. Soon 3DS 2.0, currently mainly used in Europe, could emerge as a global standard in the future.

Solutions

01

Gaming

Sed ac magna sit amet risus tristique interdum at vel velit. In hac habitasse platea dictumst.

02

CBD & Nutraceutical

Sed ac magna sit amet risus tristique interdum at vel velit. In hac habitasse platea dictumst.

03

Adults Business

Sed ac magna sit amet risus tristique interdum at vel velit. In hac habitasse platea dictumst.

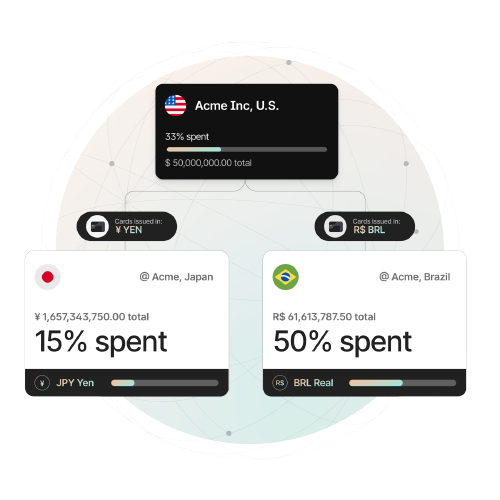

“We needed a better card and spend management solution to serve everyone faster and deliver a better experience for end users.”

---- Josh Pickles, Head of Global Strategic Sourcing and Procurement, DoorDash

and many more……..

TIME named Brex to the TIME100 Most Influential Companies list for making an extraordinary impact around the world.

Bloomberg interviews Brex Co-CEO Henrique Dubugras on AI-driven spend management and banking innovation.

Bloomberg interviews Brex Co-CEO Henrique Dubugras on AI-driven spend management and banking innovation.

Bloomberg interviews Brex Co-CEO Henrique Dubugras on AI-driven spend management and banking innovation.

PSPs – 5

ISOs – 4

Secure

SOC 2 Certification PCI DSS Compliant Multi-factor ID authentication 24/7 global fraud monitoring Self-serve Security & Privacy Center

Integrated

ERP and accounting Productivity and HRIS API automations Security and dedicated SSO SSO for Enterprise IdP

Hands-on

Dedicated account specialist Dedicated customer success manager Implementation and training support 24/7 customer service 24/7 travel agent support

Have questions about our payment solutions? Want to learn more about how we can help your high-risk business?

Our team is here to help. Contact us today to schedule a consultation and see how TickleCharge can help your business succeed.

Know here

- What currencies do you support?

-

We can recieve and hold in more than 20 currencies. We take most, except on the sanction list.

- Do you hold money for chargeback?

-

Yes, if there is a chargeback, the money will be taken out of your account. You will receive a chargeback form to dispute transaction, incase you do not agree with the chargeback. Incase you win, the same money will be transferred back into your account. Please note, if there are too many chargebacks or the underwriter deems fit, they can keep a side a reserve. Reserve is done on a case by case basis only.

- Do I have to pay annual charges to Visa or MasterCard?

-

If your business is required registered as high risk, there will be a $500 one-time Visa registration fee, post approval of the account.

- Do I need a US based bank account?

-

Yes, unless we approve you under a different country.

- How will I integrate TickleCharge with my existing software?

-

TickleCharge team will be available to assist you at every stage. From obaording to implementation, from setting your custom dashboard to regular updates, TickleCharge team will work beside you.

- Does TickleCharge payment gateway support recurring billing?

-

Yes! We understand that just like any other business such as a magazine subscription, high-risk websites and apps too need recurring payment models. TickleCharge can empower your business to automatically invoice customers monthly/quarterly/annually or using some other schedule.

PCI DSS Compliant Payment Gateways for Casinos

In today’s digital age, online transactions have become the norm...

Read MoreMastercard and Visa’s High-Risk Fees Surge: From $450 to $950 – What Merchants Need to Know

Mastercard and Visa from April 1, 2024 announced a significant...

Read MoreWe will be glad to hear from you