Stay ahead in the dynamic world of iGaming by marking...

Read MoreTickleCharge - Your Comprehensive Payment Solution for High-Risk Industries

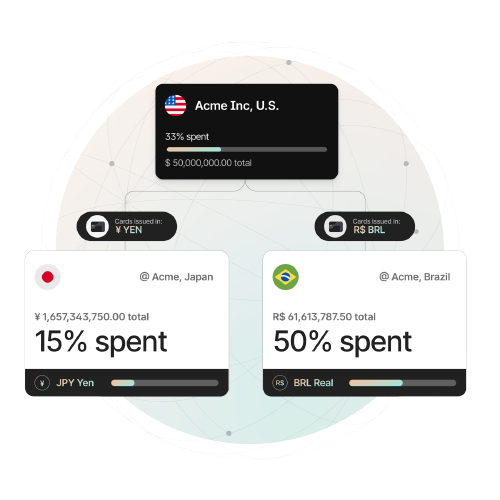

Accept Visa, MasterCard, Discover, Amex, JCB, and Crypto with easy all-inclusive merchant integration

About us

At TickleCharge, we understand the challenges high-risk businesses face when it comes to payment processing. That is why we offer comprehensive payment solutions tailored to your business needs. We work tirelessly to negotiate the best rates from our network of payment processors and banks, and we provide unparalleled support and future-ready fintech solutions to ensure that your business stays ahead of the curve.

We help high-risk businesses like yours secure merchant accounts that fit your unique needs. We know that sometimes, unknown mistakes or information on your website can cause delays or problems in getting a merchant account, but with TickleCharge on your side, you can trust our expertise and guidance. We also offer assistance with all the necessary paperwork to ensure that your merchant account is set up correctly.

Our key service USP is our ability to handhold clients through the merchant’s journey.

Customized Solutions

Our tailored approach ensures that your payment processing is not just efficient but also perfectly suited to your business and pocket.

Expert Guidance

From tackling bank paperwork to staying updated on evolving regulations and ensuring robust security measures, we've got you covered.

Fraud and Chargeback Support

Connect with one of our third-party fraud protection experts, to safeguard high-risk industries, offering you a solid defense against potential threats.

Legal Support

In the world of changing rules, a specialised high-risk lawyer is like a shield against uncertainty. Talk to one of our partner lawyers to get your legalities streamlined.

Customized Solutions

Our tailored approach ensures that your payment processing is not just efficient but also perfectly suited to your business and pocket.

Expert Guidance

From tackling bank paperwork to staying updated on evolving regulations and ensuring robust security measures, we’ve got you covered.

Fraud and Chargeback Support

Connect with one of our third-party fraud protection experts, to safeguard high-risk industries, offering you a solid defense against potential threats.

Legal Support

In the world of changing rules, a specialised high-risk lawyer is like a shield against uncertainty. Talk to one of our partner lawyers to get your legalities streamlined.

Here’s how TickleCharge helps merchants maintain high payment security standards and comply with the latest SCA requirements.

3DS challenges

The primary obstacles to successful 3DS implementation in Europe arise from the incomplete processing of payments. This can result from issues with the authentication methods being unfamiliar or technically problematic, or from malfunctions in the backend systems responsible for payment flows.

Why implement 3DS?

The applications of 3DS extend beyond merely facilitating payments. Processes such as adding cards to digital wallets, integrating open banking services, and incorporating 3DS into financial services applications all take advantage of its functionalities. Soon 3DS 2.0, currently mainly used in Europe, could emerge as a global standard in the future.

Solutions

01

Gaming

Sed ac magna sit amet risus tristique interdum at vel velit. In hac habitasse platea dictumst.

02

CBD & Nutraceutical

Sed ac magna sit amet risus tristique interdum at vel velit. In hac habitasse platea dictumst.

03

Adults Business

Sed ac magna sit amet risus tristique interdum at vel velit. In hac habitasse platea dictumst.

“We needed a better card and spend management solution to serve everyone faster and deliver a better experience for end users.”

---- Josh Pickles, Head of Global Strategic Sourcing and Procurement, DoorDash

and many more……..

TIME named Brex to the TIME100 Most Influential Companies list for making an extraordinary impact around the world.

Bloomberg interviews Brex Co-CEO Henrique Dubugras on AI-driven spend management and banking innovation.

Bloomberg interviews Brex Co-CEO Henrique Dubugras on AI-driven spend management and banking innovation.

Bloomberg interviews Brex Co-CEO Henrique Dubugras on AI-driven spend management and banking innovation.

PSPs – 5

ISOs – 4

Secure

SOC 2 Certification PCI DSS Compliant Multi-factor ID authentication 24/7 global fraud monitoring Self-serve Security & Privacy Center

Integrated

ERP and accounting Productivity and HRIS API automations Security and dedicated SSO SSO for Enterprise IdP

Hands-on

Dedicated account specialist Dedicated customer success manager Implementation and training support 24/7 customer service 24/7 travel agent support

Have questions about our payment solutions? Want to learn more about how we can help your high-risk business?

Our team is here to help. Contact us today to schedule a consultation and see how TickleCharge can help your business succeed.

Know here

- What currencies do you support?

-

We can recieve and hold in more than 20 currencies. We take most, except on the sanction list.

- Do you support cross-border payments?

-

The simple answer is yes, but the complicated answer is, it depends on your credentials and requirement. For cross-border payments, a request needs to be made for our team to work for the same

- Do you hold money for chargeback?

-

Yes, if there is a chargeback, the money will be taken out of your account. You will receive a chargeback form to dispute the transaction, in case you do not agree with the chargeback. In case you win, the same money will be transferred back into your account. Please note, if there are too many chargebacks or the underwriter deems fit, they can keep aside reserve. Reserve is done on a case-by-case basis only and It could be 5% or 10% for 90-180 days.

- Do I have to pay annual charges to Visa or MasterCard?

-

If your business is required registered as high risk, there will be a $500 one-time Visa registration fee, post approval of the account.

- Do you offer payments globally?

-

Yes, we have partner acquirers globally, including the USA, UK, EUROPE, AUSTRALIA, AFRICA, ASIA, and Latin America helping us in providing stable payment solutions, globally.

- Are startups accepted?

-

Yes, we do accept start-ups depending on the vertical, volume, and their future potential. We consider ourselves as one and are always ready to support the thriving entreupreunership ecosystem. For more details, please fill out the above form

- What kind of merchants do you accept?

-

We accept merchants who are in a legal licensed domain.

- Do you provide any other services than processing?

-

We at TickleCharge are a 360-degree payment provider. Our goal is to provide solutions for our merchants to run a frictionless company. Along with payment gateway and processing, we also via our partnerships provide: >Chargeback/fraud prevention solution >Open Banking >High risk Advisory

- What is APM?

-

Alternative Payment Methods is self explanatory and can be defined as a form of payment which is an alternative to traditional card processing. The most popular alternative payment methods are prepaid cards, digital wallets, mobile payments, UPI, and BNPL (Buy Now Pay Later) loans.

- Which are your specialist sectors?

-

Gaming, online casinos, adults, cannabis, and forex are our specialist sectors. We also have an appetite for other high-risk businesses based on the risk associated with it.

- How long does it take to integrate the TickleCharge solution?

-

TickleCharge works with reputed acquirers worldwide that provide plugins on platforms like WordPress, woocommerce, Bubble.io, etc. which are easy to activate and take not more than 1-2 hours if you have the tech team. If the plugin is not available, we share the API right after the approval, so your tech team can start the integration. For assistance, we create an email chain or Skype group with the acquirer’s tech team to assist in integration.

- Do I need a US based bank account?

-

Yes, if you are a USA entity. For other, your bank should be in the country of your business. Remember, a bank letter or a cancelled cheque will help you in acquiring your high-risk processing.

- How will I integrate TickleCharge with my existing software?

-

The TickleCharge team will be available to assist you at every stage. From onboarding to implementation, from setting your custom dashboard to regular updates, the TickleCharge team will work beside you. Incase an outside orchestratization platform/payment gateway is used, the team will guide you for the same aswell.

- What is a orchestratization platform?

-

Payment orchestration is based on the same foundation as of payment gateway. The difference is the route of the transaction is static in the payment gateway, whereas in the payment orchestration platform, the route can be dynamic. The orchestration platform has rules engines that can not only determine the optimal transaction routing based on cost, approval rates, geography, and other factors, they can also dynamically select which available payment methods should be presented to the consumer at the point of checkout.

- Does TickleCharge payment gateway support recurring billing?

-

Yes! We understand that just like any other business such as a magazine subscription, high-risk websites and apps too need recurring payment models. TickleCharge can empower your business to automatically invoice customers monthly/quarterly/annually or using some other schedule.

- What kind of payment methods do you accept?

-

We accept all kinds of cards (incl. VISA, Mastercard, Discovery, JCB, Amex), ACH, Crypto, and APM

- Do you accept MOTO payments?

-

Unfortunately, we do not offer MOTO payment or Virtual Terminal, actively. Some of our partner acquirers do have the capability and a special request can be made. This request can be evaluated on case to case basis and depends on the transaction value and vertical.

- Is the settlement in FIAT?

-

Mostly yes, but it also depends on a case-to-case basis.

- What is open banking and why do I need it?

-

"Open banking is a new financial services model allowing third-party developers to access financial data in traditional banking systems through application programming interfaces (APIs)." If you are looking for more control over your financial information, freedom to customise, and, most importantly take data-driven decisions then open banking might be for you. Talk to our experts to evaluate if this is a service for you

- Is your expertise in sextech+adult?

-

We did start with adult and sextech because of our parent company’s history in sexual wellbeing but we in no term only focus on sextech/adult companies. We have an array of clients all across industries, whether AI, CBD, iGaming.

- What is Rolling Reserve?

-

Rolling Reserve is a certain percentage of your settlement that an acquirer or payment provider keeps to themselves. It could be 5% or 10% for 90-180 days. This reserve is to settle the card scheme’s fines and protect the MID issued to the merchant. In high-risk payments, a rolling reserve is like an insurance policy. Unless it is used in an unfortunate scenario, the merchant gets it back after the processing period is over.

The Benefits of Partnering with TickleCharge for High-Risk Merchant Accounts: A Detailed Case Study

Problem: Managing payments as a high-risk business comes with unique...

Read MorePayment Processors for Your Online Gambling Merchant Account

Problem: Running an online gambling business presents unique challenges, especially...

Read MoreWe will be glad to hear from you