Open banking is turning the efficiency of moving money in the digital world. Through the use of third-party financial services providers to capture bank account details as well as to initiate payment in the line of the customers’ instruction, open banking enhances speed of transfer between accounts and institutions.

Open banking payments have been gradually gaining popularity in the USA in the recent years. This has been made possible with changes in polices that foster technology adoption and innovation in the fintech space and the drive by the banks and other financial institutions to digitise their money movement and pass on the customer choice.

Some key benefits of open banking payments include:

Greater convenience – It takes less time to complete a transaction than writing and mailing checks or waiting for bank transfers.

Additional choices and self-determination – Consumers are free to choose the provider and the method of payment whichoped for. This enhances financial access to the financially excluded individuals in the society.

Spending, budgeting and saving– Third party app can receive, process, and therefore organize account data to provide information and perform financial management.

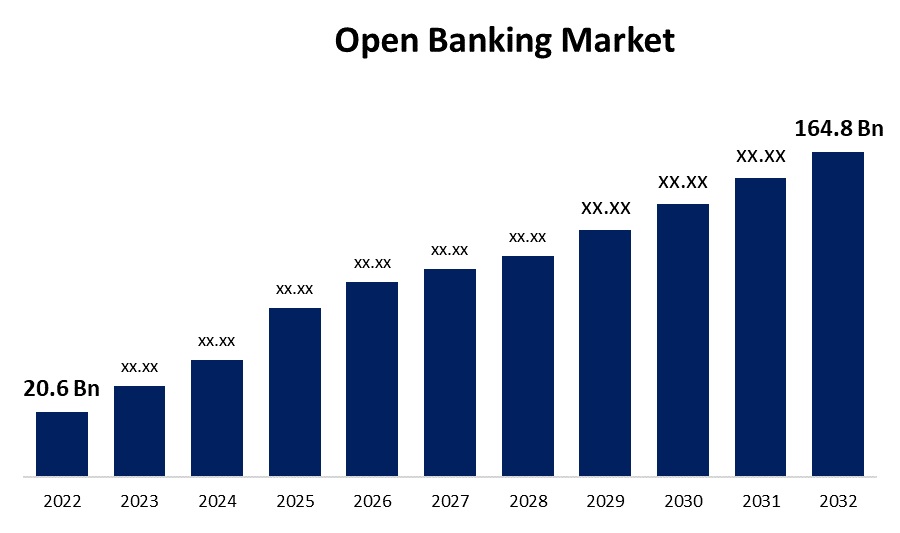

Open banking payments themselves, while comprising less than 10% of all digital transactions in the US at present, will likely experience further growth in the next few years according to McKinsey. Taking into account the amount of payments originated through open banking, they expect the numbers to grow from 15 to 130 billion US dollars in 2025.

Firms that are currently offering this kind of connectivity solutions include Plaid, TrueLayer, Dwolla and Token. They are helping banks, fintechs, merchants and payment systems to do what they have not done with legacy rails – reimagine money movement.

As the consumer data-sharing and carrying out of transactions through third-party applications increases, open banking will become more popular among the mainstream consumers in America. It is not impossible in due course for these integrated money transfer solutions to reimagine common payments with linked bank account information instead of cards or cash. This can only enhance the future for financial administration and commerce as we know it.

Combining open banking services with traditional digital payment system architectures presents the opportunity to change the foundation of certain payment rails and make money transfers between agents more efficient than has ever been previously possible. The United States society gains the potential to benefit from immeasurable worth in commercial and consumer activities if such adoption is realized in future years.